Fred Wilson's Loss & How AirBed&Breakfast was Saved By Cereals

Yet another day, yet another opportunity. Did you know you could've gotten a 10% stake in Airbnb for $150,000?

Hello there!

This one’s about the story of Airbnb.

Story For You

Startups have ruled the ‘riskiest investment’ lists since their popularity skyrocketed in the 1970s. They’re the epitome of perilous journeys, and most of them never even reach their destination. The odds are horrendous. Ten start-ups that compete on equal grounds, more or less around the same scratch line, eventually lead to only one victor. The game rules are unfair. There are no consolation prizes. The sprint begins with some equipped participants (those who were successful in raising funds) and unequipped participants (those who are still bootstrapped) creating their runways and racing toward the finish line. The stakes are high. One winner, nine losers. Midway, half of them crash out and burn. Two of them are met with the same fate in the final third. One doesn’t refuel (raise another round of funding) and the other gives up just a couple of meters away from victory. And that leaves room for one winner, who is mobbed by the media, venture capitalists, angel investors, and start-up newbies.

“That was amazing! How did you do it?”

And no matter what philosophy the winner comes up with, they cannot say with absolute certainty how they did it. It’s a combination of everything - a cocktail with unlabeled ingredients that clicked and worked. Timing. Opportunity. Idea. Team. Execution. A bit of luck.

Nevertheless, we will take a look at what the successful founders had to say about winning the race.

“We are our choices. Build yourself a great story.”

Jeff Bezos, Amazon Founder

“All humans are entrepreneurs not because they should start companies but because the will to create is encoded in human DNA.”

Reed Hoffman, LinkedIn Cofounder

“It’s hard to do a really good job on anything you don’t think about in the shower.”

Paul Graham, Y Combinator Cofounder

That last quote there. Paul Graham. Sounds familiar. Maybe he’s a part of the story that follows.

No doubt, it’s a grueling process. The workload is gargantuan and pulling 13-15 hour workdays becomes the standard (not by compulsion but by excitement and drive). Weekends lose their importance, the pressure risks implosion and uncertainty is your new best friend. If the start-up strikes a chord with its customers, users, clients, and investors, however, the rewards outweigh the struggles. Startup founders fail every day to become overnight successes.

Even though 9 out of 10 start-ups never cross the finish line, that hasn’t stopped millions of people from trying. One such start-up tried and succeeded and today, we’re going to give you a glimpse of what they went through.

Airbnb

Two young, unemployed and broke men, Brian Chesky and Joe Gebbia couldn’t make rent in San Francisco in 2007. Having recently shifted from New York, they needed the extra cash and soon. One of them noticed something odd in the hotels around their area - they were all booked! Seizing the opportunity, they bought a few airbeds and with the promise of offering breakfast in the morning, priced the package at $80/night. AirBednBreakfast.com was born with three guests sleeping on their floor.

Nathan Blecharczyk, the Harvard graduate and architect became the third cofounder a while later but the issue still remained growth. After a website relaunch in 2008, followed closely by the Democratic National Convention in Denver, over 600 people stayed at Airbnbs.

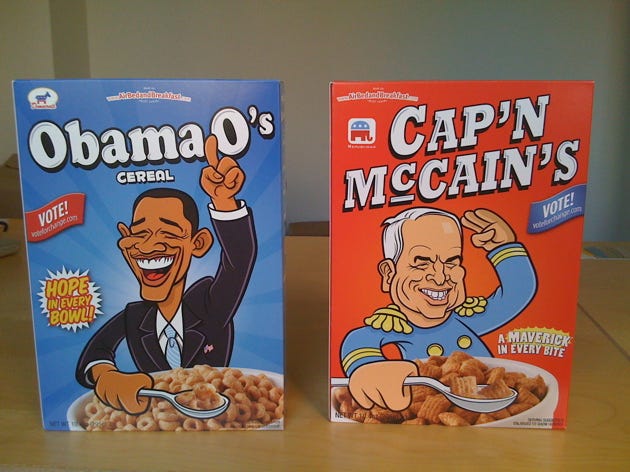

At this point, you would think all’s well but it wasn’t. There wasn’t much the three of them could do to keep the company afloat. They needed money urgently and surprisingly, a boon came in the form of cereals. Yup, the founders of Airbnb sold election-themed cereals (Obama O’s and Cap’n McCains) to keep their company up and running.

The first plausible funding, of $20,000, was made by Paul Graham at Y Combinator. Remember Paul? The quote guy from above. He even tried to rope in Fred Wilson, a venture capitalist with an impressive portfolio (Twitter, Tumblr, Foursquare, Zynga, Kickstarter, and Etsy to name a few) to invest in Airbnb.

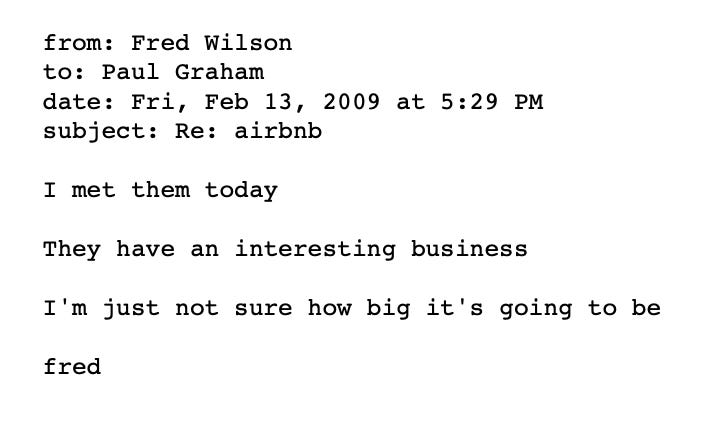

Fred passed on the opportunity, even after a series of convincing emails from Paul! This is what Fred wrote to Paul.

You can find the whole email thread between Paul Graham, Fred Wilson and the Brian Chesky here.

Airbnb launched in 2008. Do you know what else happened in 2008? The Great Recession. It was a horrible time for the world, especially the U.S. Unemployment was at its highest, people had lost about 70% of their net worth and the nation was in turmoil. The crash of the housing market had created a hatred for ownership so people looked at alternatives; and because everyone had gone in survival mode, they sought to cheaper accommodation. That’s when Airbnb took off. Ahh, what timing!

At one point, you could’ve bought a 10% stake in Airbnb for $150,000. Let that sink in. Today, Airbnb is valued at over $70 billion. 7 investors rejected the idea. Five of them couldn’t see the value in it and two never bothered to reply. Fred Wilson even kept a box of the famous cereals to remind himself of the mistake every day.

So what was it that helped Airbnb become a success? Was it timing? Or was it the idea? No, but, without the execution, it wouldn’t have been scalable, right? It must’ve been the team then. Or seizing the opportunity at the right time? Was it a bit of luck?

Guess we’ll never know.

And like any other founder that made it, Brian Chesky also said a few words that turned into quotes.

When you start a company, it’s more an art than a science because it’s totally unknown. Instead of solving high-profile problems, try to solve something that’s deeply personal to you. Ideally, if you’re an ordinary person and you’ve just solved your problem, you might have solved the problem for millions of people.

Brian Chesky, Cofounder of Airbnb

Story From You

The emergence of start-ups has been drastic over the past few years. They’re popping up like babies around every corner of the world. But with so many to choose from, how exactly do you decide which one is right for your money? It’s not like every start-up is going to succeed but you surely want to increase your odds.

What are some of the things you look for when you hear a pitch or look at a start-up’s deck?

Can’t wait to hear from y’all,

Aamer