Fintech Companies Bootstrapping Their Way To Profits

Funding fintech startups is on the rise but will companies like Zerodha and Papara lock out investors?

Hey Zedites,

We know it’s a Sunday and we know we’re slightly late but, in our defense, we’ve stayed true to the word ‘triweekly’.

A Story For You

Oblivious to the majority of us, the term ‘fintech’ was first coined in 1993, way before the internet actually became mainstream. Back then, in all its simplicity, it meant upcoming technology that would benefit financial processes. It wouldn’t be until the turn of the century, that fintech would be established as one of the fastest-growing industries in the world. The global financial technology market, which stood at $110.59 billion in 2020, is expected to increase at a 20.5% CAGR (compound annual growth rate) to reach $700 billion in 2030.

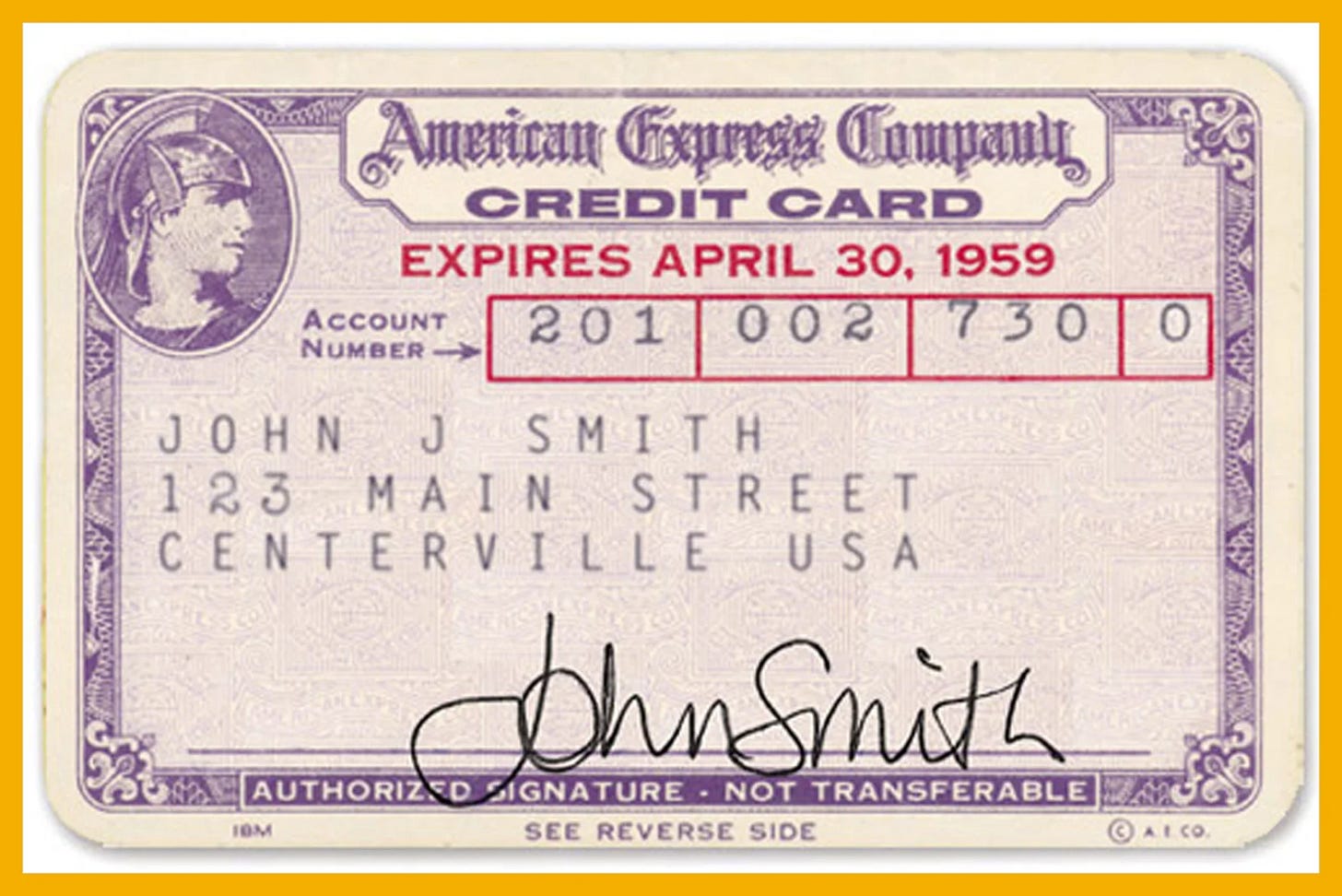

Pundits would, however, argue that we’ve seen phases of fintech throughout our history, if we go by the definition of the term in 1993. Our first groundbreaking shift was using currency, i.e. gold and silver coins instead of the ever-so-obsolete barter system. The inconvenience of gold in our pockets led us to monetize paper; we then invented the first ever credit card - the Diners Club card, after which we swiftly moved to online banking followed by, what seems to be the inevitable use of cryptocurrency.

Turning points, scattered throughout our days of yore, have brought about the change that we live through today. The Global Financial Crisis in 2008, was the freshest transition. Among other things, the reputation of financial institutions took a hit and people sought alternatives for the way their money was handled. For so many years, the banking industry, which had little to no competition, had angered the general public after Lehman Brothers filed for bankruptcy. And that created opportunity.

‘Many of Lehman Brothers’ top employees who left in the aftermath of its collapse decided to start their own businesses. A generation of entrepreneurs rose from the ashes, but many were disillusioned with the financial system.

(Credits: Revolut)

The Global Financial Crisis gave birth to the fintech industry we know today. Companies like Ant Financial, Stripe, PayPal, Square and Visa hold a big chunk of the market share of an industry that looked painstakingly stagnant for a long time. It took a housing bubble and an awful recession for us to revolutionize the industry. Banking, payments, financial management, lending, borrowing, investing—all of these segments are now catered to by upcoming fintech startups. And it’s safe to say that angel investors, venture capitalists and fund managers have pounced on the opportunity.

If you’re funding a startup, you’re looking for a hefty return on investment to make it worthwhile. That’s the primary goal of investing hard-earned money—you’re looking to grow it with minimal responsibility. The steep graph is indicative of past companies in this sector proving themselves and becoming unicorns, which is why investors are following suit, looking for the next BIG thing. And best believe, they have a fear of missing out. Several investors missed out on the opportunity of being vested in the dot-com boom, the cryptocurrency spike and sectors like fintech after the crisis, but they’ve learnt from their past and are not willing to repeat the same mistake.

However, bootstrapping is gaining popularity. And if you’ve been active on LinkedIn these past couple of days, bootstrapped startups are being lauded for their efforts of making it big without seeking external investment. Even though it’s safe to say that not every startup is going bootstrap their way to glory, the idea of it is enough to disgruntle investors, who’re always on the lookout.

Bootstrapping is a term used in business to refer to the process of using only existing resources, such as personal savings, personal computing equipment, and garage space, to start and grow a company. This approach is in contrast to bringing on investors to provide capital, or taking on debt to fund a business’ expansion. It’s about stretching what you’ve got—whatever that is—to get the job done.

(Credits: Shopify)

And so, we present two examples of startups with little to no external investment.

Zerodha

The unique name is a portmanteau of Zero and ‘Rodha’, the Sanskrit word for barrier. Founded in 2010 by two brothers, Nithin and Nikhil Kamath, Zerodha aimed to, as the name suggests, help the Indian population invest in the stock market without any obstructions. Troubled by the cumbersome commissions charged by brokerage firms, Nithin Kamath, who started trading when he was 17, sought to provide technology-efficient and cost-effective solutions to Indian investors.

At the time, the focus was on building a customer-centric product, which meant a hassle-free user interface and trading charges which wouldn’t break the bank. Since their inception, Zerodha has hardly ever had a marketing budget. They do not run advertisements, instead they let their product speak for itself. In 13 years, Zerodha has managed to attract 6 million active users to the platform, having relied only on word-of-mouth.

Let’s talk numbers. The Bangalore-based unicorn boasted an operating revenue of around INR 5000 crores ($615 million) in FY22, an 82% increase from the previous year and a ridiculous profit of around INR 2100 crores ($258 million), up by 87% compared to FY21. At a time when their competition was struggling to stay afloat, Zerodha managed to become India’s largest online discount broking company, without raising any funding rounds.

The company has stayed true to its core, charging merely INR 20 ($0.25) for every transaction, irrespective of the amount being traded. In a country where pricing is everything, Zerodha cracked the code to being favorites among all age groups.

Unfortunately, for investors, they were held up by the bouncers, unable to sneak their way in.

Papara

A 26-year-old Ahmed Faruk Karslı (now 32), founded Papara back in 2016, in Turkey. Launching his first company at the age of 17, he would go on to build several more in various sectors such as telecommunications, retail before establishing Papara in an effort to offer instant, free, multi-currency transfers to consumers as well as providing a one-stop-shop for paying bills, trading digital currencies and tracking spending habits.

Papara, unlike other startups, has only had one seed round where it raised close to $2 million. And that’s all it took for the platform to be home to 14 million users with a transaction volume of $20 billion, making it the biggest fintech startup in Turkey. Granted that a majority of the users registered during COVID-19, it has been able to sustain and improve its platform by being customer-focused.

Turkey’s largest bank by assets, ZiraatBank, serves just nine million mobile banking customers, and two million internet banking customers. This is according to the bank’s 2019 financial results.

(Credit: Fintech Futures)

Ahmed found a gap in the market—bothered by the limitations of traditional banks, he looked to improve the Turkish banking experience by building a platform that did everything a bank did, but better.

Papara started making profits in its second year and has been profitable ever since—$50 million in profits in 2022 alone.

30% of the population in Turkey still remains unbanked and Papara aims to cater to this segment without raising another round of funds.

Bootstrapping is not a newfound concept and is certainly not restricted to the fintech sector alone. The list of externally unfunded startups is long but with the amount of investments being made, the ratio of bootstrapped companies to funded companies is certainly low. The question is: Will we be seeing a change in the number of startups asking for investment in the future given that there are several examples of companies making it on their own? Or is it too early to decide?

Bootstrapped,

Aamer

Interesting. How about getting these founders you mentioned to ZedMedium podcasts.